Mention and Explain Different Types of Capital Available to Companies

Understanding the variety of capital types available is pertinent when weighing the pros and cons of each. The characteristics of common stock are defined by the state within.

A New Campaign to Help Ukraine Startups With a Silicon Valley-Style Launch.

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

. New Products or New Markets. Financial capital is vital for getting a business off the ground and will come from both. The share capital of company may be of the following types.

It consists of two different types. Primary Market- Also know as New Issue Market it is the first time market trading of new securities and later available for institutions and individuals. The six types of capital include financial capital.

Here is the list of different types of capital market in secondary market available for trading securities. Retained earnings are part of the profit that has been kept separately by the organisation and which will help in strengthening the business. There are three types of financial capital.

Pros of Debt Capital. Contributed capital is the amount of money which the company owners have invested at the. The capital market is divided into two parts.

Debt Capital Capital that has been raised as a debt to creditors. This is often the primary type of funding for a business. Examples of Capital types.

They fall into two main categories. Debt capital refers to borrowed funds that must be repaid at a later date usually with interest. Heres a breakdown of the different sources of capital that could meet your needs.

There are many different sources of capitaleach with its own requirements and investment goals. Financial Capital Under this method the cashamount is handed over to a business by an individual venture capital or Venture Capital Or Venture capital VC refers to a type of long-term finance extended to startups with high-growth potential to help them succeed. The capital so stated is called Registered Authorized or Nominal Capital.

Types of Capital Investment Usually capital investments that are undertaken may fall under two broad categories. At the time of registration of a company the Memorandum of Association mentions the amount of capital a company is authorised to raise from the public by selling shares which is known as Authorised Capital or Normal Capital or Registered Capital. Some of the top ways to raise capital are through angel investors venture capitalists government grants and small business loans.

It is also important for the economy at large as it often leads to research and development. This type of capital comes from two sources. A new capital investment project is important for the growth and expansion of a company.

The Memorandum of Association of every company has to specify the amount of capital with which it wants to be registered. 1 Lakh as minimum share capital. 2 You can get a tax deduction if you file the principal amount borrowed and interest payments as business expenses.

Debt financing which essentially means you borrow money and repay it with interest. There are three different types of share capital categories - Authorised Capital Paid-Up Capital and Subscribed Capital. Financial capitalis necessary in order to get a business off the ground.

There are two general types of share capital which are common stock and preferred stock. In simple words it refers to an investment in the companys equity stock for becoming a shareholder of the organization. The small companies that keep Ukraines economy buoyant are teaming up to keep money flowing in.

Equity capital is the money owned by the shareholders or owners. Intellectual capital and natural capital. Debt capital involves funds that are borrowed and to be paid at a later date typically with interest.

Financial capital is one of the most common and well-known forms of capital in a business. Share capital refers to the funds that a company raises from selling shares to investors. For public limited companies that sum was Rs.

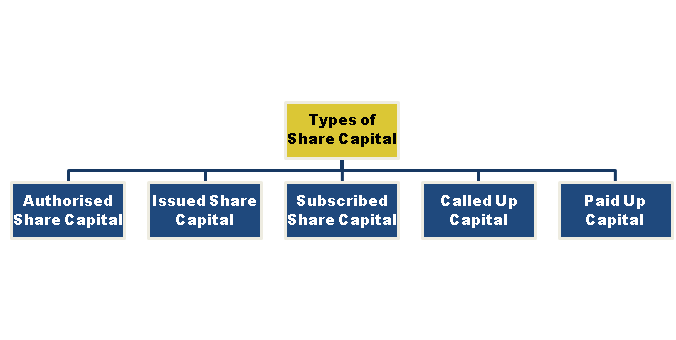

Share capital can be categorized as authorized share capital issued share capital subscribed share capital called up share capital and paid up share capital. An organisation provides securities to the public to accumulate funds and satisfy its long term goals. Authorized share capital refers to the total capital that a company is authorized to.

There are various types of secondary markets where an individual investor or a company can buy or sell securities from one person to other person. What I Know Christine. And equity financing where money is invested in your.

It supports both private and public offerings. Financial Capital From a finance perspective the capital of a business is broken into three categories according to its source and liquidity. Below are the 5 types of instruments that are traded in the capital market.

1 You retain 100 ownership of your business because you do not lose any equity. Theres also sweat equity which can be harder to gauge but is still helpful to keep in mind especially when youre looking at a small or startup business. Equity debt and specialty.

For example the sale of 1000 shares at 15 per share raises 15000 of share capital. Equity Capital Equity capital is cash paid into a business by investors. Types of debt include.

Why is capital important in business. Capital is must for every organization as it is the measure of the ability of the organization to pay off short term as well as long term expenses. Keeping these pros and cons in mind becomes imperative to making responsible choices when seeking financing options for a corporations continued growth.

This type of project is one that is either for expansion into a new product line or a new product market often called the target. Common types of debt capital are. 3 Lower interest rates.

Share Capital of a Company Type 1. October 17 2021. Tax deductibles also have an impact on the interest rates you get to pay.

A business capital structure is the way that it is funded either through debt loans or equity shares sold to investors financing. Registered Authorised or Nominal Capital. Manufacturing capital social capital.

Equity securities refer to the part of ownership that is held by shareholders in a company. Financial backing usually includes loans grants or investor funding. Under the Companies Act 2013 any private limited company had to authorise or release a minimum of Rs.

Share Capital Kinds What Are The 5 Kinds Of Share Capital In India

What Is Capital Definition Types And Examples Pareto Labs

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Comments

Post a Comment